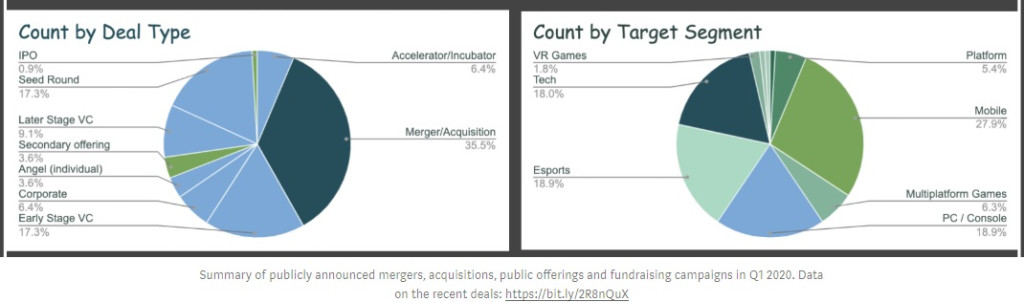

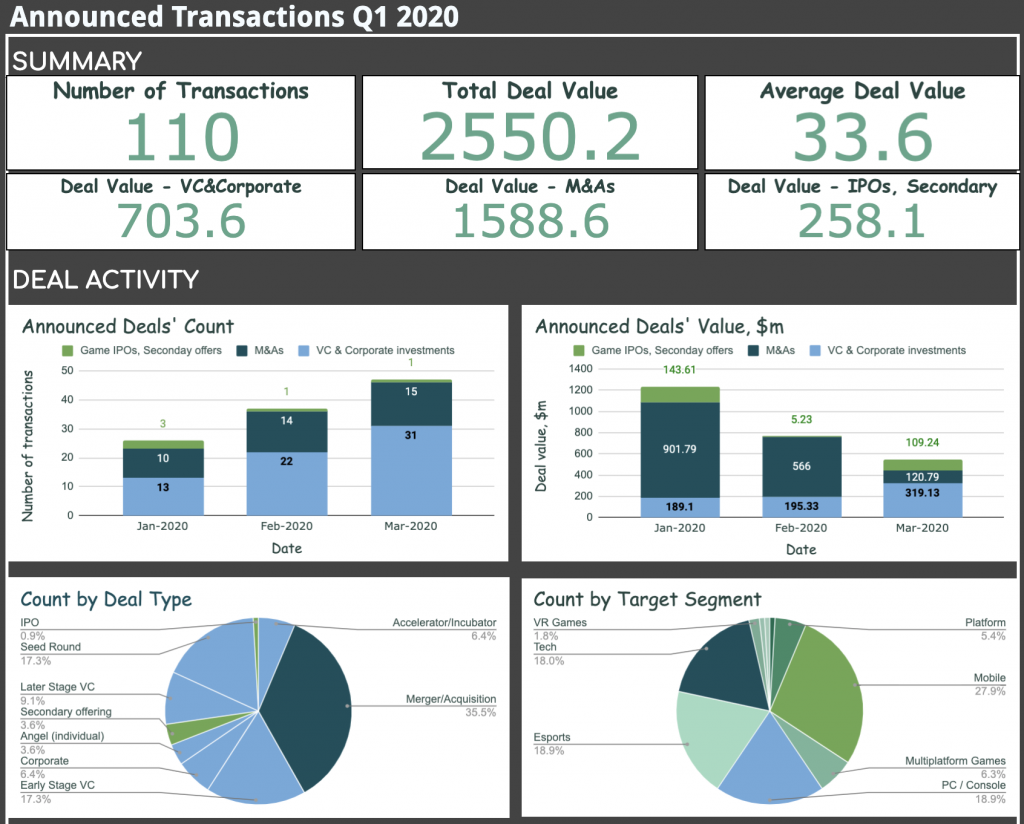

Summary — Deal Activity Q1 2020

- $0.7b games investment in Q1 2020— a decline compared to the previous year. Two funding deals (Scopely and Roblox) accounted for 50% of the deal value

- VC capital is highly concentrated in the United States with 30 VC deals successfully closed by US companies raising a total of $468m (65% of the amount raised by a games company in Q1 2020)

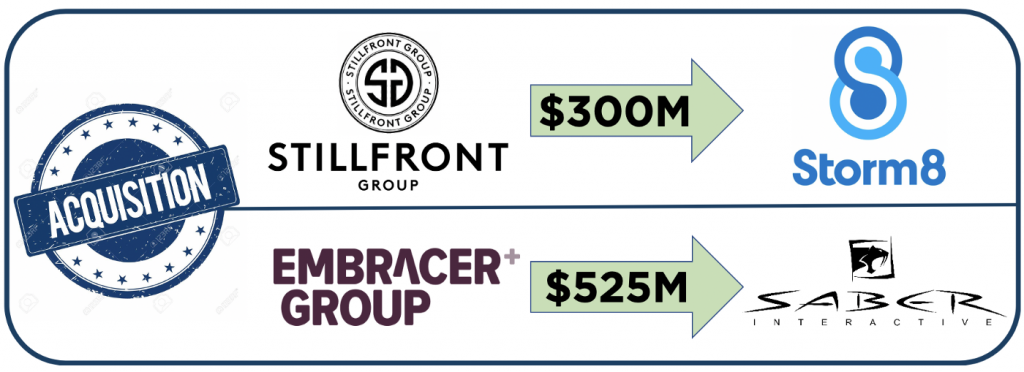

- Games acquisition market is growing with $1.6b spent by strategic players. Swedish publicly traded video game holdings Embracer (formerly THQ Nordic) and Stillfront Group continue to consolidate the market

- Games IPO market is frozen with only one IPO of NACON raising $109m

Summary — COVID-19 impact

- VC funding activity will decline in the next 3–6 months

- Strategic investment activity will stay the same or even increase. We should observe more M&As by the end of 2020

- Over the last decade, it is the first time when a three-year IPO repeating cycle will be gone. The IPO market will probably reach its lowest level.

Overview of Game Investments and Exits in Q1 2020

After another record year of game investments $7.2b in 2019, Venture Capital (VC) funds and strategic players invested $0.7b into game companies in the first quarter of 2020. This means a decline of 2.7x times compared to the average quarterly fundraising activity of the previous year ($3.8b in the first half of 2019 — or $1.9b per quarter).

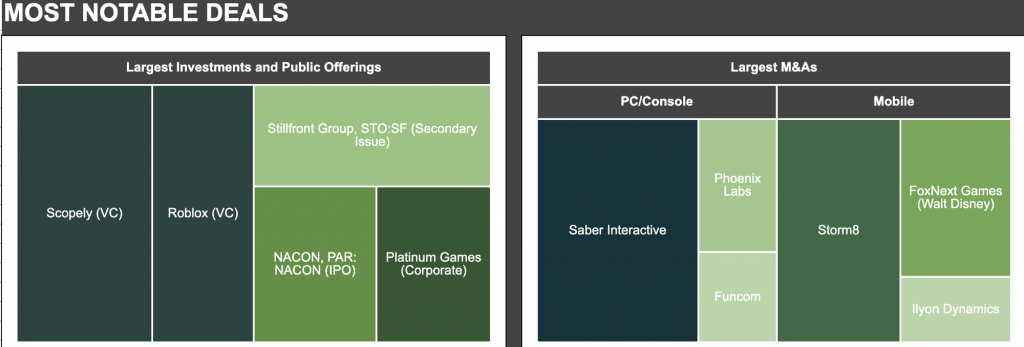

The two largest rounds over the last 3 months were raised by California-based unicorns:

- After the acquisition of Disney’s FoxNext Games for the estimated purchase price of $250m, California-based mobile game developer and publisher, Scopely has raised $200M at a $1.9B post-money valuation, bringing the company’s Series D round to a total of $400m.

- California-based online gaming platform Roblox has raised $150M in Series G funding at $4.0B post-money valuation, led by Andreessen Horowitz’s late-stage venture fund.

In general, gaming venture capital is highly concentrated in the United States with 20 VC deals (around $428m) closed in California and 10 more VC deals (+$40m) in other states of America.

The volume of M&As increased and accounted for around $1.6b overthe last 3 months compared to only $1b of deal volume for the first half of 2019. By far the largest acquisitions over the last quarter were performed by publicly traded Swedish video game holdings:

- Stillfront Group AB acquired California-based mobile casual game developer Storm8 for $300m with additional earn-out consideration of $100m (subject to reaching EBIT targets in 2020 and 2021);

- Embracer Group AB (formerly THQ Nordic) acquired US-based PC- and console-focused game developer and publisher Saber Interactive for $150m with additional earn-out consideration of $375m (subject to fulfillment of milestones). The company remains an extremely active buyer in the market with 8+deals over the last twelve months.

In January 2020, Tencent has made a voluntary cash offer (around $100m) to acquire 67.55% shares of publicly traded Oslo-based Funcom, the game developer behind Conan Exiles, Dune, and some 28 other titles. The deal has been approved on 25 March 2020.

Over the last decade, games IPOs have gone through three-year repeating cycles where one huge year is followed by two quiet ones. The last high came in the record year for game IPOs in 2017, with substantially low games IPO activity in 2018 and 2019. According to the three-year repeating cycle, we should anticipate growth in total money raised through IPO at the start of 2020.

Nevertheless, there was only one tracked IPO on March 4, 2020. NACON, previously the gaming division of BigBen Interactive,a publisher-developer of video games and a designer-distributor of premium gaming accessories. The IPO of NACON on the regulated market of Euronext Paris allowed the company to successfully raise a share capital of around $109m.

Impact of COVID-19 on the investments and exits in the video game industry. What comes next?

Venture Capital & Strategic Investors Deal Activity

AggregateVC fund’s deal flow remained strong in Q1 and was largely unaffected by the economic slowdown brought on by COVID-19. Such dealmaking activity despite the recent economic slowdown is explained by a longer lead and closing time compared to the public market, meaning that many deals announced in March were negotiated prior to the economic downturn.

However, we should expect a decline in the venture fund deals over the next few months — most likely VC funds will focus on keeping the existing portfolio companies afloat and provide capital to them rather than establishing new relationships.

Ther are multiple reasons for this:

- macroeconomic uncertainty caused by oil price volatility, a sudden rise in the unemployment rates and new data of COVID-19 patients;

- lack of in-person meetings which slows down sourcing and negotiation activity;

- delays in registering companies and approving the deals by government authorities;

- certain limitations on due diligence procedures impacting the deal quality.

On the other hand, the strategic investors that have shown a strong improvement of financial position over the past few years and experienced huge growth in the gaming software sales (as many people are stack at home) may react differently and increase their stakes in promising gaming companies at much lower valuations. We shouldn’t expect the immediate increase in corporate investment activity since the majority of large gaming corporations will take time to

i) determine the consequences of economic deterioration on stock prices;

ii) assess possible delays in the production;

iii) automate remote working processes, and;

iv) properly assess changing player behavior.

Some strategic investors will pull back focusing only on the existing portfolio, but those with dedicated corporate investment teams with a strong financial position will continue investing prudently. It is the right moment to continue consolidating the market by acquiring later-stage companies that are likely to observe substantial valuation reductions being often valued relative to public peers, which fell in price.

Public Offerings Activity

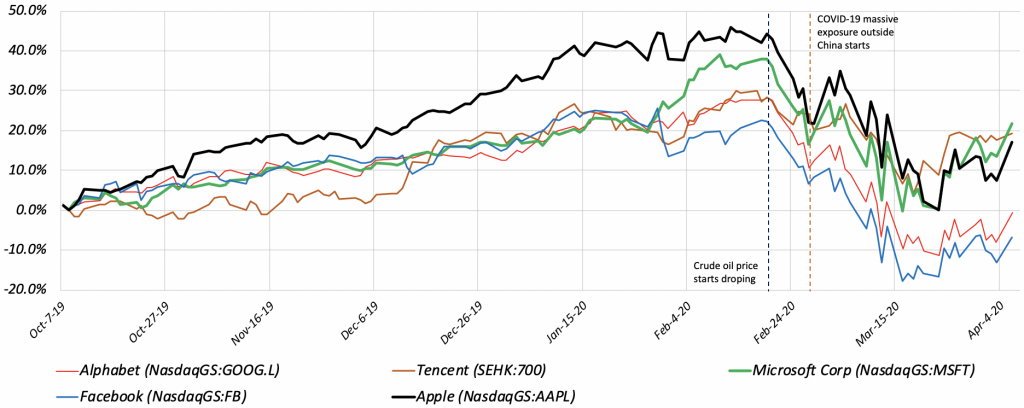

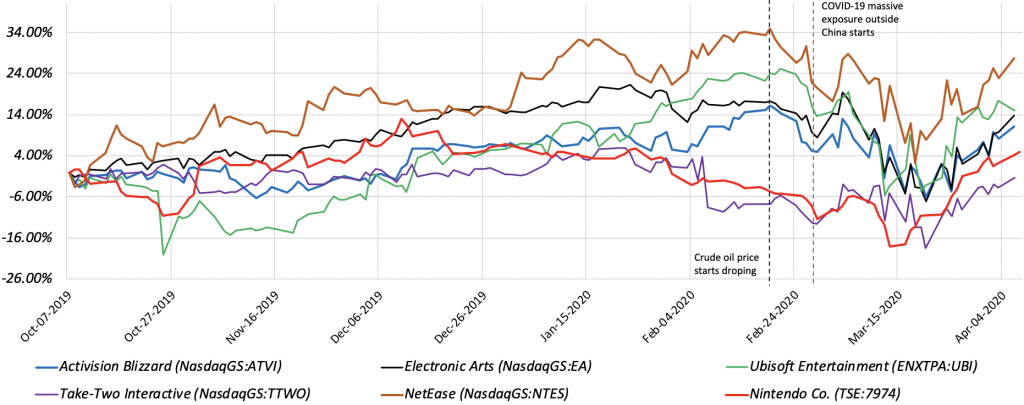

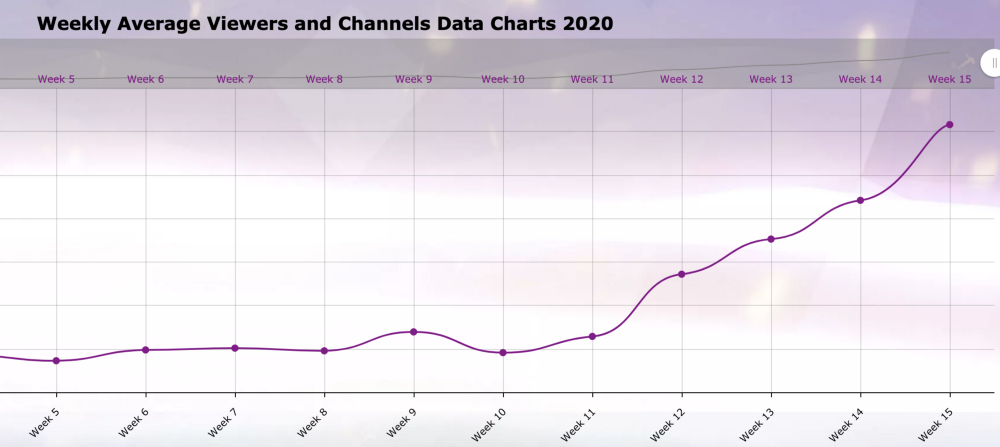

We should have expected growth in game IPO activity at the start of 2020… Unfortunately, the IPO window closed quickly as the enormous volatility returned to public equities. Starting the end of February 2020 all entertainment software companies demonstrate a significant drop in share prices, which was followed by a gradual increase over the last several weeks (March 20 — April 5).

The uncertainty raised from a sharp decrease in oil prices and the coronavirus outbreak has reshaped the 2020 IPO timeline. Assuming markets will stabilize in the second quarter, more companies will tentatively target fall IPOs. Nevertheless, it’s going to be a dreadful year for public offerings as fears about the scale of the macroeconomic downturn will hurt investor sentiment and impact public markets.

There’s light at the end of the tunnel

Despite all that said above, there are several mitigating factors worth noting.

First, we observe a strong surge in interest around video games leading to an increase in video game sales worldwide, the amount of time spent playing, live game streaming and other good news. As more and more people around the world self-isolate and get introduced to the world of interactive entertainment, we expect more new gamers to become accustomed to playing and eventually paying in video games. Not only we project the short-term positive dynamics, but also long-term favorable changes in the gamer audience are possible.

Moreover, video games are generally thought to be a recession-resistant consumer product. During economic recessions, players exhibit a reduction in discretionary spending, as a result, expenditure on entertainment is directed to the lowest-cost possible options. Given that playing video games is cheaper and more exciting compared to other entertainment options, game sales might actually increase in the mid- and long-term perspective.

Second, M&A activity will most probably continue on its growth. Just recently Embracer Group (formerly THQ Nordic) raised $164m through a directed share issue to make further acquisitions of development studios and publishers. The startups needing to raise capital or other struggling companies may become potential targets to prepared strategics that could make smart acquisitions or acqui-hires at attractive prices and terms quickly beginning to favor the seller.

Finally, today’s venture industry is more sustainable and liquid relative to the previous economic downturns. Not only we have plenty of VC funds (Play Ventures, Makers Fund, London Venture Partners, BITKRAFT, etc.) and huge Private Equity groups(Andreessen Horowitz, KKR, SilverLake, Blackstone) are interested in the entertainment, but also corporate venture capital funds putting additional capital in the gaming startups. This week US mobile game developer-turned-platform N3twork has announced a $50m publishing fund.

We also see the development of the secondaries market (i.e. secondary public offering) in providing more liquidity opportunities for stakeholders.