The company will use the funds to scale its AI-driven cloud platform, onboard thousands of new characters, and expand its commercial activities.

Founded in 2019, Hour One develops technologies for creating high-quality digital characters based on real people. Utilizing deep learning and generative adversarial neural networks, Hour One generates production-grade video-based characters in a highly scalable and cost-effective way. And now the company announced it has completed its $5 million seed funding led by interactive content and technology investor Galaxy Interactive via its Galaxy EOS VC Fund, a partnership with EOSIO blockchain software publisher, Block.one, Remagine Ventures and Kindred Ventures with the participation of Amaranthine.

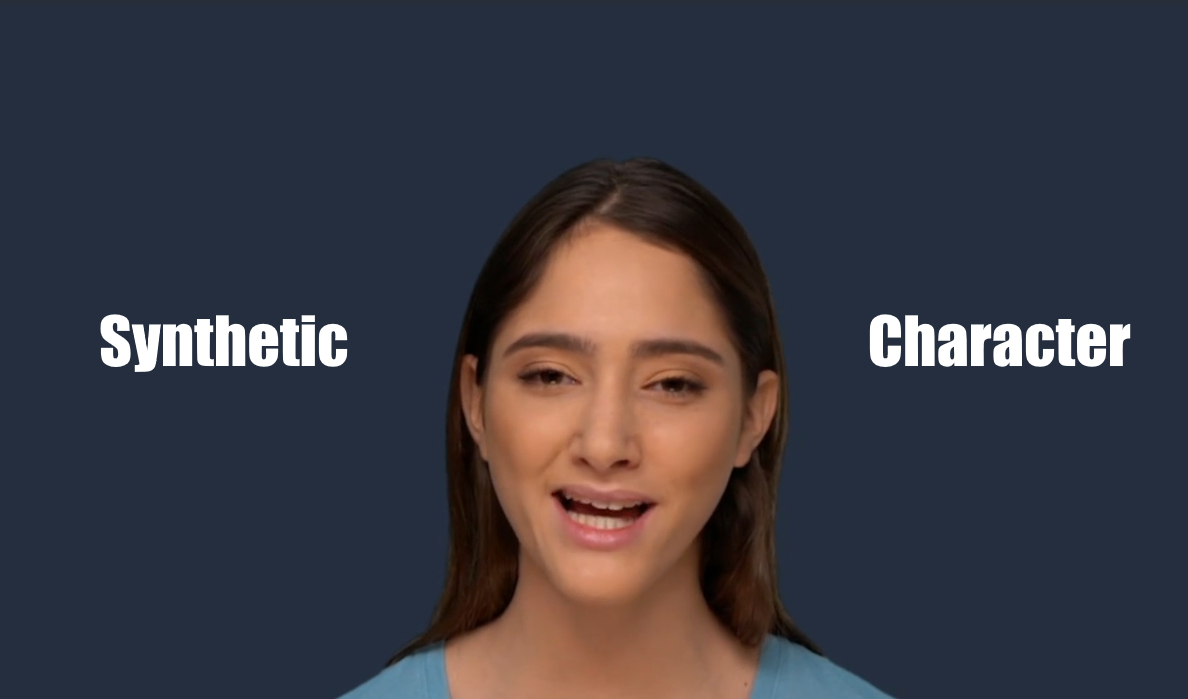

We believe that synthetic characters of real people will become a part of our everyday life. Our vision is that Hour One will drive the use of synthetic characters to improve the quality of communication between businesses and people across markets and use cases. By enabling each person to create their own character together with our scalable cloud platform, we will provide a variety of solutions for next-gen remote business-to-human interactions.

Oren Aharon, Hour One’s Founder and CEO

The investment comes at a time of tremendous momentum for the company. In January 2020, Hour One began deploying its videos across sectors where immersive video with digital human characters drives engagement. Hour One is currently working with companies in the e-commerce, education, automotive, communication, and enterprise sectors, with expanded industry applications expected throughout 2020. The company also showcased its “real or synthetic” likeness test at CES 2020, challenging people to distinguish between real and synthetic characters generated by its AI.

With the reduction in the cost per character use that the solution affords, companies are no longer constrained in how many videos they can create, “in essence, any textual content can now be automatically translated into a live-action video of a person that engages an audience by speaking the text” said Eze Vidra, Co-Founder and Managing Partner at Remagine Ventures.

Hour One’s technology is truly best-in-class, as is their ethics-driven approach to the creation of synthetic video and it’s something that can’t be ignored given the implications of this groundbreaking innovation. Given how challenging production with live actors has become as a result of COVID-19, now is the perfect time for businesses of all sizes to produce their content with Hour One’s synthetic characters.

Sam Englebardt, Co-Founder and Managing Director of Galaxy Interactive

Now more than ever companies of all sizes understand that they need to dramatically change how they engage with their customers. And now, with Hour One, they can rapidly, efficiently, and programmatically introduce exceptional customer video experiences, as a primary and affordable way of doing that. We’re delighted to have invested in a first-mover with such a disruptive solution.

Eze Vidra, Co-Founder and Managing Partner at Remagine Ventures

About Galaxy Interactive

Galaxy Interactive is a division of Galaxy Digital, a diversified merchant bank specializing in digital assets and blockchain technology. Led by Sam Englebardt (one of Galaxy Digital’s partners and co-founders) and Richard Kim, Galaxy Interactive manages and invests from the $325mm Galaxy EOS VC Fund (a partnership with a software development company, Block.one) with a particular focus on video games, esports, digital objects, virtual and augmented reality (VR/AR) and lifestyle applications that are leveraging the EOSIO blockchain protocol and other technologies to power their businesses.

About Remagine Ventures

Remagine Ventures is an early stage venture capital fund investing in startups at the intersection of tech, entertainment, data and commerce with a spotlight on Israel. Remagine Ventures is backed by some of the leading corporates in the media industry and covers the full spectrum of opportunity within the Israeli market – accelerating the startup go to market by facilitating commercial relationships leveraging the fund’s strategic investor network.