The competitive mobile game maker is going public through a quick initial public offering process, with the transaction values at 6.3 times its projected 2022 revenue.

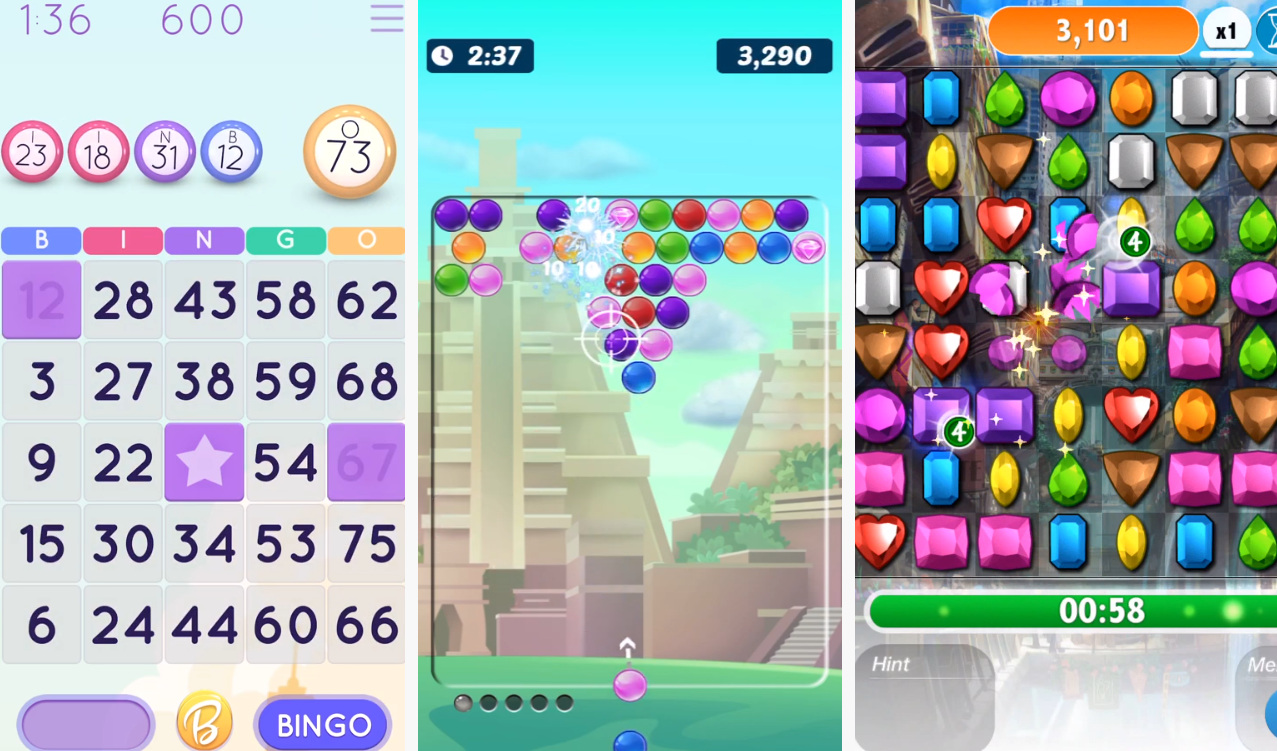

The Skillz platform helps developers build multi-million dollar franchises by enabling social competition in their games. Leveraging its patented technology, Skillz hosts billions of casual esports tournaments for millions of mobile players worldwide, and distributes millions in prizes each month. Now the company is planning an IPO that will value the firm at $3.5 billion.

Becoming a public company is an important milestone for Skillz. We look forward to accelerating growth as we work with our developer partners to bring Skillz-powered competitions to every kind of game for billions of gamers worldwide.

Andrew Paradise, CEO of Skillz

Skillz is partnering with its special public acquisition company Flying Eagle Acquisition Corp, and with other investors including Wellington Management Company, Fidelity Management & Research Company, Franklin Templeton and Neuberger Berman funds. The deal has been unanimously approved by the board of directors for both Skillz and Flying Eagle, and now requires the approval of stockholders.

At the end of the transaction, Skillz will have roughly $250 million in cash and the public company investors will own around $849 million of the resulting $3.6 billion post-money valuation of the company. PIPE investors Wellington, Fidelity, Franklin Templeton, and Neuberger Berman will hold stakes in the company. The transaction is expected to close later this autumn.

Skillz’s platform is going to raise $1.6 billion from different casual esports tournaments this year in paid entry fees. Co-founders Andrew Paradise and Casey Chafkin will continue to lead the company, with CEO Paradise becoming the controlling shareholder of the new combined company.